TL;DR

Decentralized Physical Infrastructure Networks (DePIN) are a rapidly emerging crypto use case. By combining distributed infrastructure with token incentives, many of the existing problems in centralized infrastructure are solved elegantly, enabling decentralized GPUs, storage, energy, wireless, and GPS networks.

The DePIN model has three key advantages:

- Easier Capital Formation due to diversified risk of service providers. By deconstructing a single centralized provider into many independent actors of varied risk tolerances, the net risk tolerance is higher, unlocking incremental capital and experimentation.

- Bootstrapping incentives produce cash flows in the present vs the future. While centralized infrastructure invests in capital with the expectation of future cash flows, DePIN allows providers to access them almost immediately after investing.

- Tokens allow for past profits to grow along with future profits.The token model has unique advantages to payments in fiat – by creating a currency tied directly to the effectiveness of the protocol’s service, its value should theoretically increase as the network grows. As a result, net rewards are much higher.

When it comes to the most important element of the protocol design – the fee model – we conclude that fixed-flat rate pricing yields greater stability and long term value creation.

Introduction

Decentralized Physical Infrastructure Networks (DePIN) are democratized and decentralized, enabling anyone to permissionlessly become a service provider, user, and owner in the network. This idea is not new, as services like Filecoin and Helium have been operating for years and have built strong products and reputations. With the recent shortage of compute power due to the AI boom, namely GPUs for training and inference, the spotlight has refocused on DePIN as an additional method to harness latent GPUs and more effectively allocate compute power. Can DePIN help effectively democratize systems that are largely centralized in the status quo? Can they compete against AWS, AT&T, or other centralized services?

Before answering the above, we must first understand the fundamental differences in capital expenditures and network operation between DePIN and centralized approaches. Our analysis is focused on the monetary benefits of DePIN, specifically in the new approach to capital formation and expenditure. By decentralizing these processes, the core incentives and dynamics are completely changed. We advance that these changes provide distinct financial advantages to creating capable and efficient services.

Centralized Infrastructure and the Status Quo

In centralized infrastructure, capital expenditures are deployed with the expectation of future cash flows. Effective planning includes predicting demand over time and estimating the required capital and expenses to deliver future cash flows and a positive EV outcome. This process is well-understood and generally effective – centralized providers can quickly change their service capacities and react to changing conditions with minimal latency.

Additionally, the centralization of physical capital allows for unified coordination and execution. Through proprietary, closed systems, companies can create standardized processes and protocols for communication between infrastructure, backup infrastructure, and maintenance. AWS, for example, has full control over its GPUs with physical access to them at any time.

Centralized capital expenditures, however, incur large cumulative risks, as unexpected dips in demand can turn assets into expensive liabilities when underutilized. Any idle infrastructure directly hurts the bottom line, which is a shared risk throughout the organization. To mitigate this, companies tend towards low-risk capital expenditures, conservatively measuring demand and planning for expansion when needed. Over time, this strategy is generally effective, though it experiences challenges when there are substantial technological, supply chain or physical issues such as in AI (GPUs) and Oil.

DePIN, however, addresses several of these risks and issues elegantly.

The Financial Advantages of DePIN

DePIN takes the goals of any infrastructure service and deconstructs it into separate components; capital formation is outsourced to a portion of users that produce and sell services to other users.

The organizing entity, or the ‘protocol’, facilitates the exchange of services and payment, coordinates node communication, and upgrades the protocol through decentralized governance. More explicitly, DePIN network design includes:

- An incentive for service providers to join the network, typically in the form of payment proportional to their service capacity.

- Protocol logic that allows users to access services produced by providers.

- Protocol logic that facilitates user payments and payouts to service providers.

- Protocol logic that maintains supply / demand equilibrium through dynamic incentives for users and providers

- Protocol logic that defines and incentivizes network quality and health

From the above components, we derive three key capital advantages that make DePIN a more effective method to finance and operate infrastructure services in many cases.

1) Distributed Service Nodes Allow for Diversified Risk

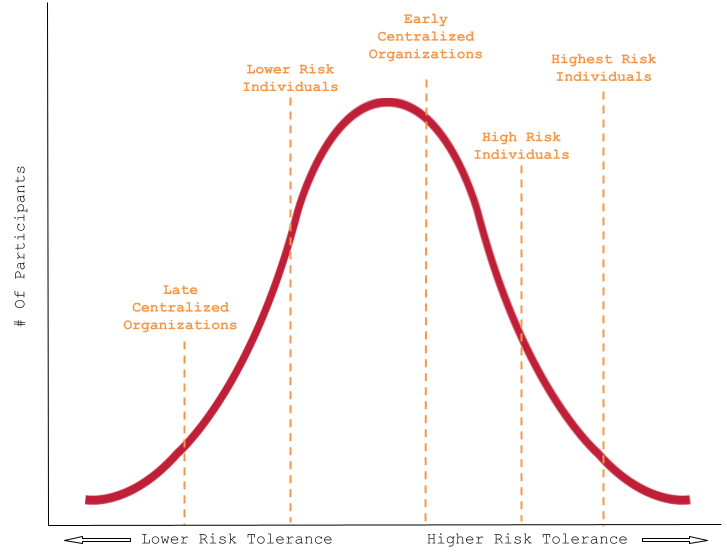

In centralized services, the aggregate risk tolerance of a population will always exceed the acceptable risk of a centralized entity, which allows for faster bootstrapping and network effects. Each service provider in the network has an inherent risk tolerance. This opens capital investment to the full spectrum of risks (e.g. think bell curve), as some providers are more comfortable with risk and the extra rewards they earn. These actors are further to the right on the risk curve. As the network grows and risk reduces, additional providers further left on the risk curve will incrementally join the network according to their own risk/reward profile.

This is a notable improvement from the single risk tolerance of a centralized service, allowing for more flexibility, physical infrastructure, and dynamic behavior in response to demand. It also accelerates innovation since new networks can raise capital and experiment with a smaller amount of capital.

Along with accessing the full range of risk tolerances, CAPEX decisions can be further right on the curve as they are a smaller percent allocation of one’s investable capital. Individual nodes are a small fraction of a network’s total capacity and are relatively cheap, allowing for more initial investment as providers are brought into the network. For example, Helium nodes cost ~$1000 and Hivemapper nodes cost ~$300. These are relatively small expenditures for a large portion of users. These new risk profiles create unprecedented levels of capital formation and innovation.

2) Bootstrapping Incentives Distribute Future Cash Flows … Today

Without sufficient users to pay for their services (demand), service providers would need to incur the risk of future demand and the generation of cash flows to cover their CAPEX. These costs can be high, and without sufficient and readily available rewards, becoming a provider for potential demand is risky. To address this, decentralized networks over-reward those joining the network in the early stages. Even with little to no demand for their services, providers are ushered into the network to induce actual demand, and get immediate extra payouts instead of waiting for future cash flows. This creates the flywheel required to mature the network and bring in more users.

3) Tokens Allow For Past Profits To Grow Along With Future Profits

In centralized models, fiat currencies are completely unchanged by the value of the network – cash flows in USD are not more or less valuable as the network becomes better or worse.

The root of this problem lies in the medium of exchange and rewards – namely the fiat currencies in use. Protocol designers have no control over its value, inflation, or distribution.

If a protocol designer uses a native token with carefully designed monetary policy, many of these problems can be solved quite elegantly. Early providers are rewarded in this token and are aligned with increasing its value by providing quality service. Thus, the rewards from providers scale with network adoption, continually incentivizing more network growth. When demand falls, the token price (should) reflect that change, disincentivizing a bloated supply side.

Of course, these solutions assume that Economics 101 is exactly true in the real world. While this is clearly untrue, the role of protocol and token designers is to incorporate smart and adaptive features to mitigate for all of the ways that the real world complicates the picture. In essence, a native token allows these networks to leverage the power of supply and demand instead of using an external and global currency with no tangible connection to the network. To make use of this power effectively requires some additional study.

Improved Design: Leveraging Speculation In Payment Design

The economic crux of DePIN design is payment mechanisms. Our analysis of this considers agent incentives, currency types, and importantly, speculation.

There exists a range in which speculation is healthy for every economy, as difficult it may be to achieve or even define. While agent types with conviction in a protocol’s success will be motivated by some amount of speculation, those with stake in the protocol are rewarded by steady, long-term growth. In the short-term, users expect reliable, consistent service and providers expect enough demand to maintain revenues. However, by receiving their rewards in a protocol token, providers are incentivized by the value of their rewards slowly increasing.

This implies that speculation, within some unknowable “optimal” range, is in fact necessary to a protocol’s overall success. How, then, can protocol designers incentivize and control these behaviors? In one approach, protocol designers can try to actively control the amount of speculation using lock-up periods for bought tokens, staking requirements, or other “sinks” in which tokens can be kept within the economy. Another approach gaining adoption is centered around a key observation: in the short-term, speculation-induced price changes directly hurt protocol agents because they transact using the market price of the protocol token. How can the market volatility be taken out of this transaction?

One answer is to create a fixed, fiat-rate price per unit of service. When users pay for services, the protocol converts their fixed rate into the equivalent token amount based on the current price of the token. Users and Providers are both guaranteed stable costs and rewards for their prices in the short-term, while long-term adoption on the network token can increase the actual value of their stake. In addition, given that expenditures are spent in USD, this also better aligns revenues and costs.

How do some of the most popular DePIN networks facilitate payments? Below, we categorize several popular protocols by payment structure. We differentiate by “fiat-pegged”, in which units of service are priced by a fixed fiat rate, and “native token”, in which prices are in terms of the native token decided by market conditions or bidding.

|

Protocol |

Fully Diluted Market Cap (FDV) |

Type |

Payment Type |

|

Filecoin |

$9.17B |

Storage |

Native Token (FIL) |

|

Bittensor |

$6.8B |

AI Marketplace |

Native Token (TAO) |

|

Render |

$1.9B |

GPU Compute |

Native Token (RNDR) |

|

Helium |

$623M |

Wireless |

Fiat-Pegged (Data Credits) |

|

Hivemapper |

$596M |

Mapping |

Fiat-Pegged (Map Credits) |

|

Arweave |

$524M |

Storage |

Native Token (AR) |

* As of Dec. 4th, 2023

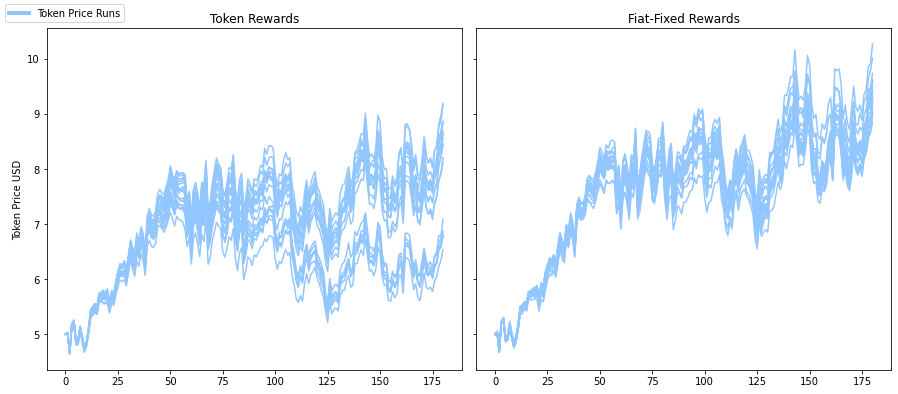

To investigate these two approaches further, we ran two separate simulations using our Agent Based Model (ABM). In practice, this design would require both a stablecoin and a network token. For the purposes of modeling, however, we set a fixed price of $0.01 per ‘unit’ of service required by users and converted this into the equivalent token amount. We first tested token rewards in which users bid for services in terms of the network token. Our second experiment used the fixed rate.

When using Fiat-Fixed rewards, the variance of the runs was lower, indicating more price stability. Additionally, there is a clear increase in price over time when using Fiat-Fixed rewards. In the first simulation, agents must bid on services in the native token, from which providers choose the highest bidders. This is similar to the Ethereum price mechanism before EIP-1559. As a result of this auction system, some higher-risk agents bid large amounts, resulting in higher token velocity and more chances for momentum to induce more speculation. In the second simulation, there is no bidding and therefore no unpredictability in the cost of services. By regulating the price of services and removing the ability to bid high or low amounts, there are less chances for outlier transactions that increase price volatility. As a result, we see a more uniform set of simulation runs and a general upward trend in price.

Summary

The goals of DePIN are ambitious and important, as they help greatly increase the efficiency of our infrastructure systems. While there are several theoretical design considerations, new use cases, including decentralized compute networks, will present new challenges. Every protocol has different design needs depending on the type of service provided. However, by abstracting DePIN protocols as a general economic model, we can find general best practices like Fiat-fixed pricing models.

By carefully considering the designs of less technically challenging DePIN networks, we can help build resilient, effective protocols to decentralize infrastructure services that are needed most.